- Latest news global cryptocurrency stock market april 28 2025

- Global cryptocurrency market latest news april 2025

Global cryptocurrency market latest news april 2025

Nebraska enacts law to prevent fraud associated with Controllable Electronic Records. On March 11, Nebraska enacted LB 609 adopting the Controllable Electronic Record Fraud Prevention Act (CERFPA), which requires operators of kiosks for controllable electronic records (CERs) such as virtual currency to obtain a state money transmitter license the imara retreat. It also requires clear and conspicuous disclosures of all terms and conditions associated with the operator’s activities, with an acknowledgment of receipt, and specifies certain content that must be included in the disclosures and the receipt. The CERFPA requires kiosk operators to take specified measures to protect against fraud, including the use of blockchain analytics, the adoption and implementation of a written antifraud policy, caps on daily transactions, the provision of live customer service by telephone, and designation of a compliance officer. Further, the CERFPA also requires the kiosk operator to refund consumers fraudulently induced to enter into a CER transaction if certain conditions are met.

CFTC withdraws staff advisory related to virtual currency derivative product listings. Also on March 28, the CFTC’s Division of Market Oversight (DMO) announced it was withdrawing Staff Advisory No. 18-14, which provided guidance and suggested greater burdens for listing virtual currency derivatives products. The DMO cited “additional staff experience” and “increasing market growth and maturity” as reasons for withdrawing the advisory.

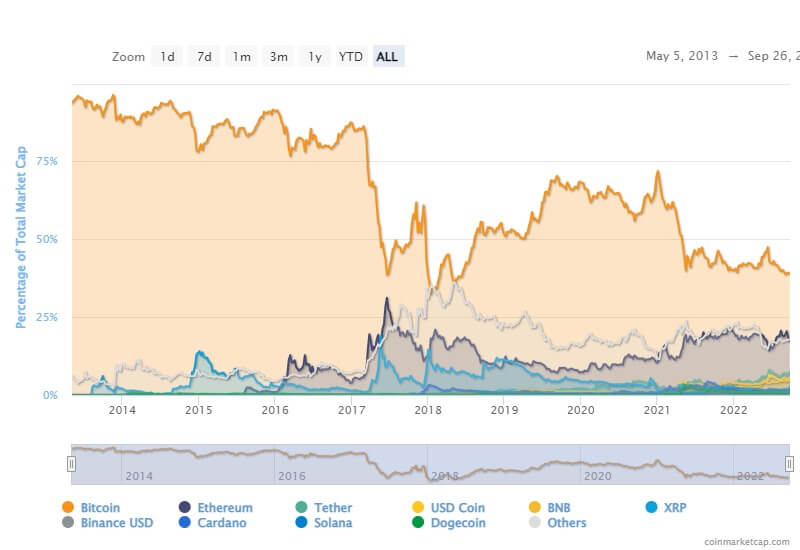

As of April 21, 2025, the global landscape across finance, artificial intelligence (AI), technology, and cryptocurrency is buzzing with significant developments. From volatile stock markets and groundbreaking AI advancements to major tech rulings and cryptocurrency innovations, these sectors are shaping the economic and technological future. This article provides a detailed roundup of the latest breaking news, offering insights for investors, businesses, and tech enthusiasts.

Latest news global cryptocurrency stock market april 28 2025

Throughout April 2025, Bitcoin exhibited significant price swings, fluctuating between $76,000 and $95,000. After hitting a low of $76,000 on April 8, BTC rebounded to $88,500, then peaked at $91,740 on April 22—its highest level since March.

Bitcoin is currently trading around $79,000 to $80,000. It went up after a big drop, showing how quickly the market changes. Some days ago, it fell nearly 5.5 percent, which was its lowest point of 2025, but it recovered fast.

On top of all this, Moody’s downgraded the U.S. economy. The Dow Jones dropped 332.9 points, the S&P 500 fell by 49 points, and the Nasdaq lost 197.1 points. Since crypto usually follows stock trends, this news made prices fall too.

The Liberals started the year trailing well behind the Conservatives as former Prime Minister Justin Trudeau stepped down. On Trump’s inauguration day, Conservatives led polling at a 44% polling average to the Liberals’ 21%.

Large-scale liquidations and Whale Sell-off: The industry is also suffering from large-scale liquidations. As per Coinglass data, in the past day, 78,525 traders were wiped out, and total liquidations hit $226.69 million. Ethereum had the most losses at $78.08 million, followed by Bitcoin at $60.48 million, and Solana at $7.94 million. Even popular tokens like AAVE, Moodeng, and Fartcoin saw liquidations.

Conservative rhetoric, including that of the pro-crypto party leader Pierre Poilievre, was decidedly pro-Trump. This connection may have been the Conservatives’ undoing, as quickly after taking office, Trump said that Canada should become America’s 51st state while simultaneously ramping up tariffs on Canadian goods.

Global cryptocurrency market latest news april 2025

Additional indirect indicators also point to rising demand for Bitcoin. Currently, the amount of Bitcoin held on centralized exchanges (CEXs) has dropped to its lowest level in five years. Historically, such declines have often preceded price increases, as illustrated in the chart.

The report emphasizes that April’s recovery was price-driven and reflected broader market maturity. Investors responded positively to dips, whale accumulation grew, and smart contract ecosystems like Cardano and Ethereum attracted attention through stability and development.

April 13The White House announced that electronics exemptions were only temporary and hinted at new tariffs on computer chips.By now, markets showed signs of fatigue, appearing less reactive to sector-specific tariff news. Gold continued to climb as a hedge, while Bitcoin and equities diverged temporarily until April 21, when they synchronized again amid renewed S&P 500 growth. Bitcoin demonstrated a higher upside response.

April 4China retaliated with a 34% tariff on U.S. imports and banned 11 American companies from operating domestically.The tit-for-tat escalation deepened market anxiety, accelerating the sell-off across equities and crypto.

April 29Trump signed executive orders adjusting auto industry tariffs to avoid overlap with existing duties on steel and aluminum.Markets appeared to await more decisive signals. Cautious optimism emerged, hinging on whether the 90-day pause would lead to lasting de-escalation.